It is seen that the total credit amount equals the total debt amount. It is fundamental to the double-entry bookkeeping system of accounting, which helps us understand from the illustration above that total assets should be equal to total liabilities. Under the accrual basis of accounting, expenses are matched with revenues on the income statement when the expenses expire or title has transferred to the buyer, rather than at the time when expenses are paid.

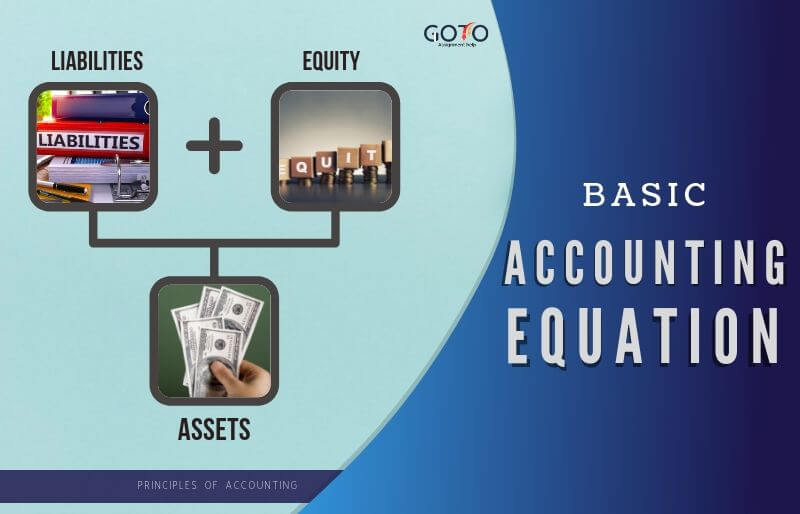

Basic Accounting Equation Formula

Not only does the balance sheet reflect the basic accounting equation as implemented, but also the income statement. Accounting Equation is based on the double-entry bookkeeping system, which means that all assets should be equal to all liabilities in the book of accounts. All the entries made to the debit side of a balance sheet should have a corresponding credit entry on the balance sheet.

How Does the Double Entry Accounting System Work?

Accounting equation describes that the total value of assets of a business entity is always equal to its liabilities plus owner’s equity. This equation is the foundation of modern double entry system of accounting being used by small proprietors to large multinational corporations. Other names used for this equation are balance sheet equation and fundamental or basic accounting equation. The balance sheet is also known as the statement of financial position and it reflects the accounting equation. The balance sheet reports a company’s assets, liabilities, and owner’s (or stockholders’) equity at a specific point in time.

Arrangement #1: Equity = Assets – Liabilities

The accounting equation is important because it allows the business or entity to correctly record transactions and, therefore, maintain their financial statements. To further illustrate the analysis of transactions reporting depreciation when trusts own business entities and their effects on the basic accounting equation, we will analyze the activities of Metro Courier, Inc., a fictitious corporation. Refer to the chart of accounts illustrated in the previous section.

- In this sense, the liabilities are considered more current than the equity.

- Investors are interested in a business’s cash flow compared to its liability, which reflects current debts and bills.

- Before explaining what this means and why the accounting equation should always balance, let’s review the meaning of the terms assets, liabilities, and owners’ equity.

- The capital would ultimately belong to you as the business owner.

A lender will better understand if enough assets cover the potential debt. In fact, most businesses don’t rely on single-entry accounting because they need more than what single-entry can provide. Single-entry accounting only shows expenses and sales but doesn’t establish how those transactions work together to determine profitability. While single-entry accounting can help you kickstart your bookkeeping knowledge, it’s a dated process that many other business owners, investors, and banks won’t rely on. That’s why you’re better off starting with double-entry bookkeeping, even if you don’t do much reporting beyond a standard profit and loss statement. The assets have been decreased by $696 but liabilities have decreased by $969 which must have caused the accounting equation to go out of balance.

Components of the Accounting Equation

Owner’s or stockholders’ equity also reports the amounts invested into the company by the owners plus the cumulative net income of the company that has not been withdrawn or distributed to the owners. The Accounting Equation is a fundamental principle that states assets must equal the sum of liabilities and shareholders equity at all times. Owners can increase their ownership share by contributing money to the company or decrease equity by withdrawing company funds. Likewise, revenues increase equity while expenses decrease equity. The above accounting equation format provides the management and the stakeholders a clear snapshot of the asset, liability and equity position at a particular point of time.

Transaction #3 results in an increase in one asset (Service Equipment) and a decrease in another asset (Cash). After the company formation, Speakers, Inc. needs to buy some equipment for installing speakers, so it purchases $20,000 of installation equipment from a manufacturer for cash. In this case, Speakers, Inc. uses its cash to buy another asset, so the asset account is decreased from the disbursement of cash and increased by the addition of installation equipment. Let’s take a look at the formation of a company to illustrate how the accounting equation works in a business situation.

It specifically highlights the amount of ownership that the business owner(s) has. And we find that the numbers balance, meaning Apple accurately reported its transactions and its double-entry system is working. Drawings are amounts taken out of the business by the business owner. To learn more about the income statement, see Income Statement Outline. Parts 2 – 6 illustrate transactions involving a sole proprietorship.Parts 7 – 10 illustrate almost identical transactions as they would take place in a corporation.Click here to skip to Part 7.